Foreword by the President and the CEO

Patrick Odier

SSF President

Sabine Döbeli

SSF CEO

SSF Strategic Priorities in the Year 2022

SSF has 3 strategic priorities, which it enacts through 9 activity fields.

SSF Strategic Priorities

Shaping and informing on best practice

Activity 1: Sustainable finance information

10 media releases published

- 6 December - “Sustainable investing” explained in a clear and concise manner: Swiss Sustainable Finance (SSF) launches an introductory video for investor

- 8 November - Swiss Sustainable Finance (SSF) sets out guidance on sustainable finance learning topics for training providers and managers in Switzerland

- 6 October - Economic prosperity threatened by the biodiversity crisis – SSF und GCNSL set up a Swiss consultation group for the Taskforce on Nature-related Financial Disclosure (TNFD)

- 24 August - SSF publishes "Setting sail for a carbon-neutral future: Net Zero Insights 2022" on the progress of net zero commitments within the Swiss financial centre

- 5 July - SSF publishes a “Practitioners' Guide” to fully integrate individual sustainability preferences into the investment advisory process

- 30 June - A strong signal: Swiss Sustainable Finance (SSF) appoints four women to the board

- 29 June - Switzerland leads the way with launch of Swiss Climate Scores for financial investments

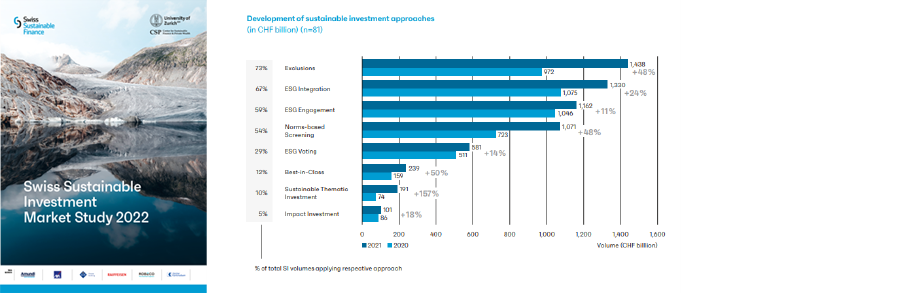

- 9 June - Total sustainable investment volumes in Switzerland climb to a new record high of CHF 1,982.7 billion – Climate debate fuels strong growth in thematic approaches

- 24 May - Credit financing as a strong lever for Switzerland’s sustainable transformation – New publication by SSF and VSKB highlights potential solutions and case studies

- 3 February - SAQ erhöht Anforderungen an Bankkundenberater*innen zu nachhaltigen Finanzthemen (German only)

710news items (or more) with reference to SSF, including articles by NZZ, Finanz und Wirtschaft, Le Temps, L’Agéfi, programs by SRF (Swiss radio and television) and various online platforms.

See SSF website for news items with appearance of SSF.

For more information see Market Study 2022 website.

For more information see Market Study 2022 website.

- Setting sail for a carbon-neutral future: Net Zero Insights 2022 (August 2022)

- Practitioners' Guide on the Integration of Sustainability Preferences into the Advisory Process for Private Clients (July 2022)

- Sustainability in Lending (May 2022)

Activity 2: Facilitation of sustainable finance education

SSF runs a subpage on Evrlearn that provides an encompassing overview on sustainable finance education

16finance profiles

In this guidance, SSF lists essential study topics and optional topics for in-depth study for different finance professions. It is intended as guidance for training providers and managers looking for education and training opportunities tailored to specific profiles. The guidelines should be seen as recommendations for excellence in sustainable finance training. Read the press release here.

Creating supportive frameworks and tools

Activity 3: Sustainable investments in wealth & asset management

18pages of content

SSF, in close collaboration with the management consultancy Ernst & Young, has drawn up recommendations in the form of a "Practitioners' Guide on the Integration of Sustainability Preferences into the Advisory Process for Private Clients". The recommendations are based on a survey and a series of interviews with SSF members as well as different workshops with the corresponding SSF focus group. SSF also hosted a webinar for SSF members detailing insights from the report and offering practical insights on the integration of sustainability preferences into the advisory process for private clients.

4language versions

The video produced by SSF explains different objectives of sustainable investments to retail clients in a simple form. It is intended to assists client advisors in starting a discussion with clients about their individual sustainability preferences and the importance of the different goals. It can be used by banks in their advisory process or on their website. The video was prepared by a focus group consisting of members of the Wealth and Asset Management Workgroup.

Activity 4: Impact Investing

Activity 5: Financing the transition to a low-carbon economy

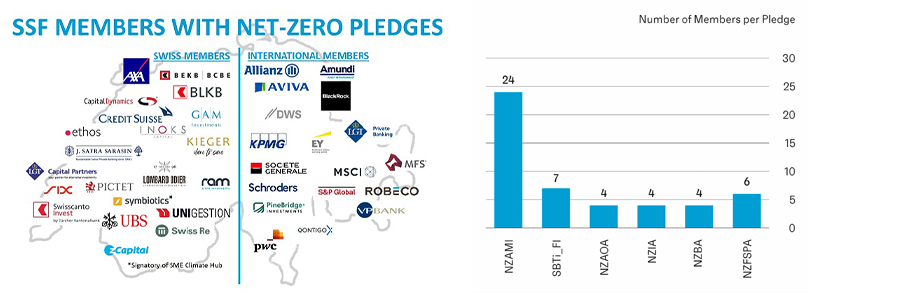

39SSF members had signed a net zero commitment *

In summer 2021, SSF put out a call to members to sign one of the net zero pledges. In 2022, SSF continued to provide support to its members through a member webinar on climate strategies for investors. Furthermore, SSF lists statements of signatories on its website.

See the full list.

Activity 6: Sustainable cooperation with members and partners

Activity 7: Political dialogue

3sustainable finance working groups

Activity 8: International representation and recognition

3international organisations with SSF as a member

- SSF represents Zurich in the UN-convened Financial Centres for Sustainability (FC4S) network and prepared the input for the annual assessment program of the network resulting in a report on frameworks for sustainable finance. SSF further attended their Annual General meeting to discuss future activities of the network.

- SSF is a member of Eurosif and brings the Swiss view into the policy work prepared by this pan-European body uniting national sustainable finance organisations.

- SSF is a member of the TNFD Forum and co-hosts the Swiss Consultation Group for the TNFD along with GCNSL.

Activity 9: Involvement of institutional asset owners (IAO)

At this webinar for Institutional Asset Owners, the SSF team and Ulla Enne, Workgroup leader of the SSF IAO workgroup, presented an overview of net-zero pledges and case studies from three SSF members already engaging in net-zero commitments.

SSF as an organisation

SSF members and network partners

At the end of 2022, SSF was supported by a total of 231 organisations (203 members and 28 network partners), which reflects a growth of 16% compared to the previous year. See the member profiles on the SSF website.

SSF Board

The SSF Board has 15 members representing different member types and regions. In 2022, SSF elected four new members to the SSF Board, all of which are women. Patrick Odier is serving his second year as President of SSF. View the profiles of the current board members on the SSF website.

SSF Team

The SSF Secretariat has 8 team members, all of which are providing their individual know-how and expertise to the organisation. In 2022, Hendrik Kimmerle started as Senior Project Manager, Veronica Baker was promoted to Project Manager and Beatrice Meyer started as Office Manager. See their profiles on the SSF website.